Reports on Demand

Research Reports on Demand

ValuEngine provides Rating and Forecast reports on over 4,200 US stocks, 600 ETFs, 16 Economic Sectors, and over 250 Industry Groups. The stock reports are 11 pages in length and powered by our quantitative models that evaluate all data fields daily.

EASY TO USE: Just enter the ticker symbol or part of the company’s name to instantly access the many pages of pertinent data and to print the reports.

Or use search tools to find new stocks not yet on your radar.

Stock Insights

ValuEngine reports provide access to a huge array of quantitative metrics essential to stock evaluation and decision making.

The four most important proprietary indicators are:

- The ValuEngine Rating: 1 (Strong Sell) through 5 (Strong Buy)

- 1 month through 3 year Forecast Price Returns

- Valuation – Unique model-driven analysis, combining many traditional and non-traditional factors.

- DAILY updates: All reports updated every day markets are open.

ValuEngine Stock Reports Include

- Actionable Buy/Hold/Sell ratings;

- Forecasted Returns for 1-month, 3-month, 6-month, 1-year, 2-Year, and 3-Year time frames;

- History of recent ratings changes;

- Forecasted EPS;

- Projected Earnings Growth Rate;

- Updated Pricing Data;

- Price/Earnings Growth Rate (PEG);

- Trailing and Forward P/E; Market/Book; Price/Sales ratios;

- Quantitative analytics including Sharpe Ratios, Beta, and Alpha;

- Historical rates of return going back 5 years;

- Extensive peer group analysis;

- Industry- and sector-relative analysis; and

- Corporate business description.

Sector/Industry Reports

- Reports on 15 Sectors and more than 200 industry groupings;

- 9-to-14 page reports include aggregate sector scores and rankings using most ValuEngine metrics;

- Top and bottom performers ranked by each metric;

- Aggregate sector balance sheets and income statements.

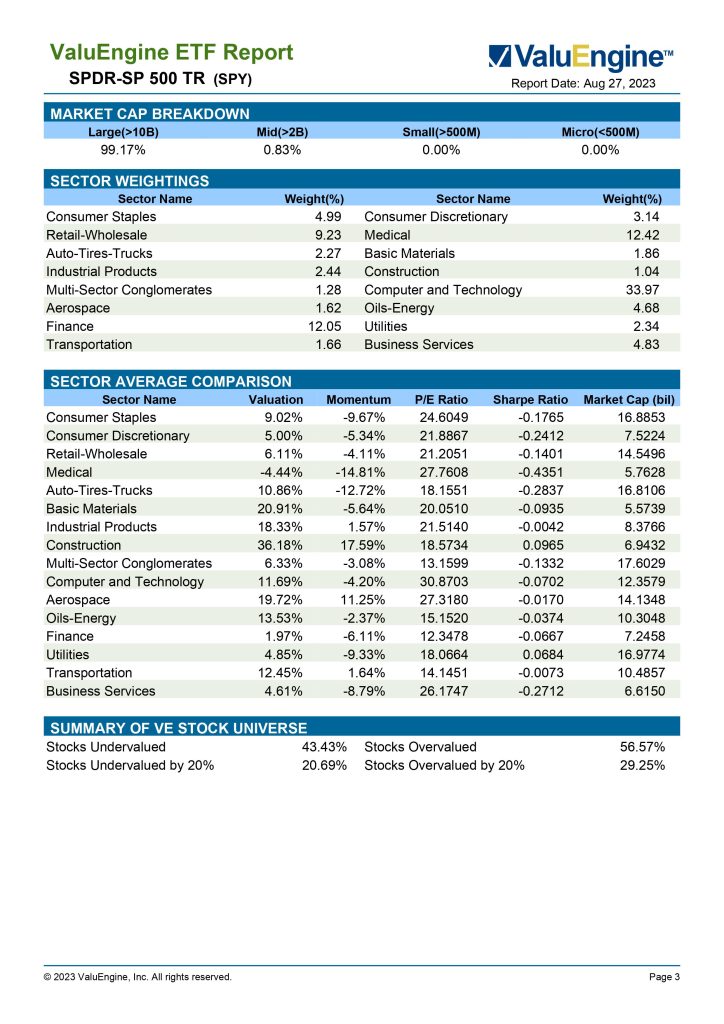

ETF Reports

- Reports on over 600 US Equity ETFs, updated weekly

- Buy, Hold, Sell ratings on each ETF

- Predictive ratings combine top-down and bottom-up analysis

- Analysis of major holdings of each ETF

- Statistical breakdowns on stock and ETF level